Welcome to mamaeats, a twice-weekly newsletter (Tues. & Sat.) inspired by a simple + seasonal home life. I’m a mother of three, avid reader, gardener, and home cook who focuses on nourishing, whole food meals with a focus on plants. This newsletter is my labor of love—if you are not already, and are able to do so, please consider becoming a subscriber to support my work here, which takes time and effort. Doing so gives you access to all the archives and recipes (find the recipe index here), as well as cook-along videos which go along with most recipes. If a recurring payment is too much for you right now, but you’d still like to contribute, I’d be delighted to receive a one-off tip via my ko-fi. As always, thank you for being here, reading this newsletter, and sending me your thoughts.

A few months ago, I published a newsletter entitled “simple finances,” where I cover the broad ideas and basics of how I approach personal finance. It is my most popular post of all time (!!), which amazes me, because as I was writing it, I remember thinking, “I’m not sure if anyone will want to read this!” Give it a read if you haven’t already, but just to give you a quick background of our household:

Both Joel and I grew up quite poor, although we had relatively happy childhoods and neither of us ever went hungry. I think this contributed to both of us being content with, and even preferring, living simply. We’ve never brought in a six figure income, but we’ve been able to live well while also saving for the future by living within our means and being considered with our money. We manage our money like it used to be normal to: we save up and then pay in cash for large purchases, we buy secondhand, we often make things ourselves, we make things last and repair them for as long as possible, we consider “want” purchases carefully and over a length of time before buying. In this way, we have also lessened our impact on the earth and been able to spend on things that matter to us (good, fair food, adventures with our 3 children, our garden, giving back to our community) while also learning so much along the way.

After a mostly “overview” newsletter last time, I thought it might be useful to share a very practical post detailing how I put these ideas into practice, each payday, year in and year out.

This is how I allocate funds from every pay period, for our household. I’m the one who manages finances in our household, although Joel and I do talk about everything, and have a once monthly brief finances meeting. A disclaimer: perhaps this sounds like a lot to you, but I promise, once you’ve got a system, it takes very little time to maintain. It’s actually not something I think about alot; it’s just something that needs to be done, like any other household duty.

Step one: write the budget.

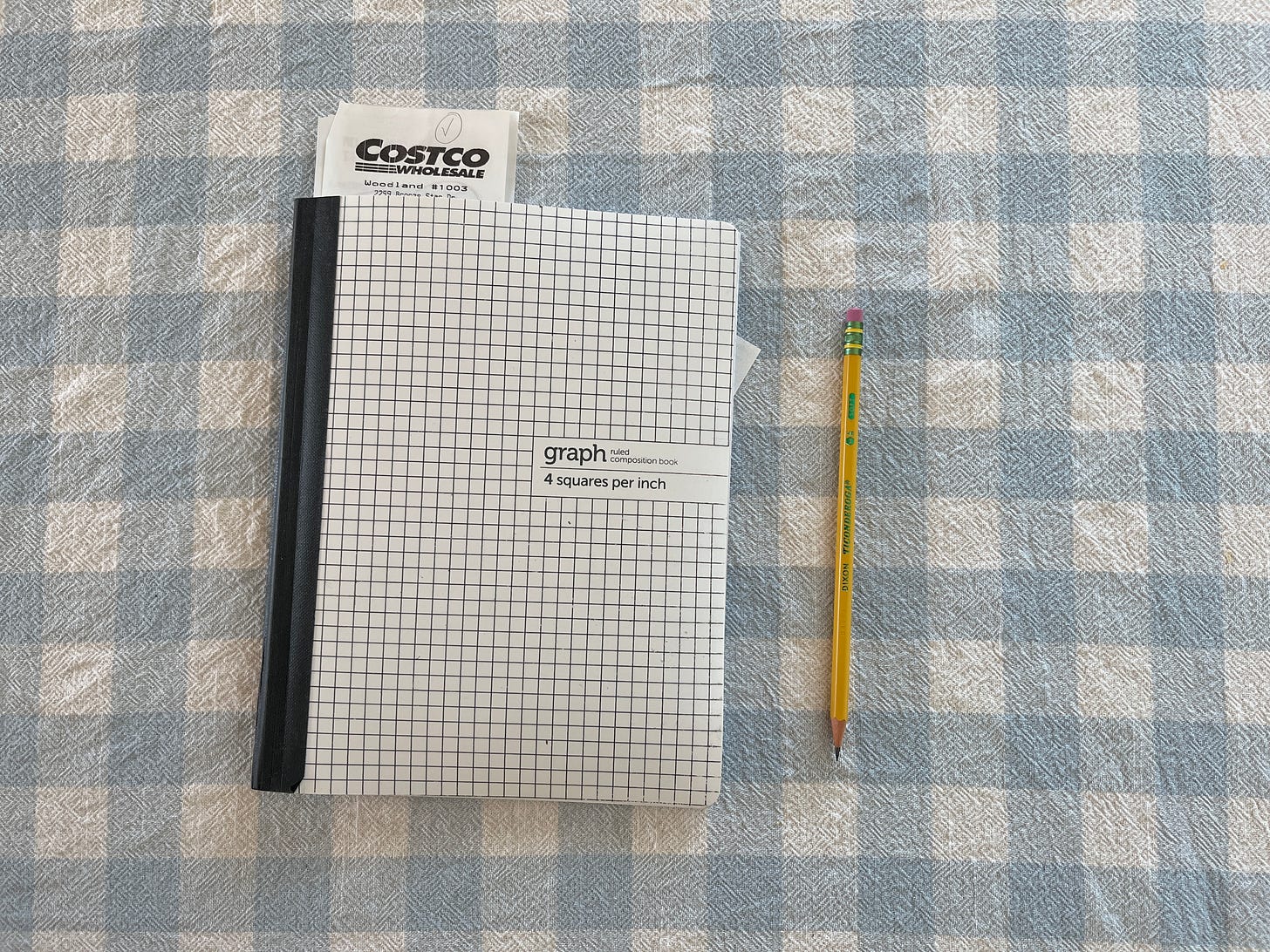

During the last week of the prior month, I write the new budget for the upcoming month. I use a zero-balance budget, which I think of as a spending plan, meaning that I have a plan “spending” each dollar and know where it will go- either saved or going towards an expense. I use a basic graph paper notebook, in which I also keep track of actual expenses in the month, sort of like a giant checkbook. (side note: I also have one for writing down bookmarked recipes in, so much nicer than trying to pull things up online constantly) It is a very simple process, and takes me around 10 minutes or less. I then go through and discuss last month’s budget and the new month’s budget quickly with Joel. If you would like me to write a newsletter about writing a budget, let me know!

Step two: get paid.

My husband is traditionally employed, and I am self employed. He is paid bi-weekly, and he has a company 401k plan with a small employer match that we contribute to. This makes the saving automatic, consistent, and impactful—that “extra” money never touches our spending account, thus we don’t miss it nor do we “accidentally” spend it. For years, he didn’t have a 401k option, and then for years he had a 401k option without a match, so the luxury of this is not lost on us!

Step three: pay yourself first.

Paying yourself first is a concept that has been fundamental to our financial health. How I used to do things was to pay the bills and spend blindly throughout the month, then at the end of the month, transfer whatever was left into savings. This never worked very well—if the money was there, without a plan, I often would overspend! Now I transfer a portion of the money over the day it is deposited in our account, ensuring that our savings stay consistent. You can also automate your transfers to make it easier.

i. contribute to an IRA (long term savings). Next, I contribute to our IRAs, which are at Vanguard (I really recommend either them or Fidelity, for low expense ratios and straightforward investing). We contribute 10% of our take home pay (I also contribute extra financial windfalls1 through the year). When I’m running the numbers, I love using my small desk calculator rather than my phone; it is so tactile and satisfying to push the keys. A small thing, but still!

ii. fund an emergency savings account. We currently have a fully funded emergency fund, so I don’t contribute to this anymore, but if I didn’t, I would next transfer money into this. Ours sits in a high yield savings account, this is the one I use. It’s for true emergencies (losing a job, unexpected/cataclysmic car or home repairs, emergency medical bills, etc). It’s essentially a cushion were something bad to happen, so that we don’t need to go into debt.

iii. Sinking funds (short-term savings). Last year I started implementing sinking funds, and they have been so wonderful at spreading out expenses evenly through the year. They are a short term savings method for larger bills/expenses that come up seasonally. I take the amount of the annual bill, and divide it by 26 (there are 26 bi-weekly pay periods in a year) to get the amount to save each pay period. For example, if I budget to spend $1500 annually on vacationing, then /26 would be $58 per pay period. These expenses are not unexpected— they come up regularly every year, and thus it makes sense to plan for them, instead of feeling surprised by them each time! I keep them in a savings account, and then transfer the money over to my checking when the bill comes due. Here are some examples of our personal sinking funds:

gifts: birthdays, Christmas, teachers gifts, hostess gifts, weddings…

car insurance, every 6 months

bulb order for autumn, every April

new (to us) car fund: for when our car must be replaced

dentist: for expenses beyond what’s covered by our insurance

summer vacation: accommodation, extra gas/transportation costs, food, tickets…

clothing

firewood: purchased in summer (when price is lower) for the coming winter

car and bike repairs: oil changes, flat tires, new tires, new headlights, bike parts, maintenance…

home repairs: appliance replacement costs, parts, repairs, paint, tools…

kids sports/school: equipment/supplies, fees, uniforms, books

annual fees: such as a costco renewal, little league fees, dues, charitable donations, subscriptions etc

CSA box payment

Step four: pay the bills.

Next, I pay any bills that are due. PG&E, city utilities, phone and internet bill, credit card statement (I pay in full each month)…those type of things. Know what bills you pay each month, how much they are, and what date they are due. I write the date they are due right next to their dollar amount on the budget. Also, it can be helpful to periodically shop around to ensure you’re getting the best rates.

Step five: fun.

After paying myself, and the bills, if there is money in excess, it is ours to do with as we wish. We divide it between Joel and I for pocket money for whatever we like. Money is fun and is there to spend when you’ve taken care of the necessities. For us, this usually isn’t a large amount, but plenty enough for fun, simple pleasures that are very enjoyable to us—meeting up with a friend for a cup of coffee and a pastry, taking the children out for a gelato or boba, seeing a film at our independent cinema, buying a new book, cookbook, or a nice thing we’ve wanted for the kitchen. We are completely satisfied with this, and find it deeply freeing to have financial peace, much more so than overextending ourselves to just to accumulate and consume material goods.

Step six: close out the month.

At the end of the month, I review the paper budget that I wrote before the month began, checking it against what we actually spent that month. Sometimes, if we didn’t spend all the money I allocated for a category, such as “garden”, I’ll roll over those funds into next month’s budget for a cushion. Or, I simply transfer the extra money into savings. If we spent more than expected in a certain category, I make a note and update the next month’s budget with a higher amount, perhaps cutting back the budget in an area where we underspent.

I hope you found this post helpful, if you did, please let me know by liking, restacking, or commenting. Thank you, as always, for spending your precious time here reading what I write. The specialness of that is never lost on me; I appreciate you!

Bonus step: extras.

We are comfortable, and used to, living on the income that we make every month. So, when there’s an extra amount of money (tax returns, the couple months that have 3 paychecks because of the bi-weekly schedule, bonuses and raises) we tuck that away into our retirement accounts or savings, too. Occasionally, we’ll spend some of it if there’s something that we’ve been really wanting for a while, but is not in the budget/sinking funds. But mostly, it gets saved for another time! This is how we’ve been able to avoid lifestyle creep (when your standard of living rises alongside your discretionary income) and save a large percentage of our income while making a modest income.

This is very similar to my routine and yes, to analog! I've tried using spreadsheets in the past but nothing beats my trusty notebook. It gets messy at times! I am going to steal the stapling the receipts though - that is a good idea. I also really love these practical types of post - so useful!

This is a romantic version of what i do hahah, i.e. excel spreadsheets